by Admin

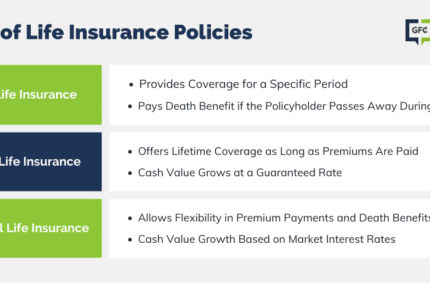

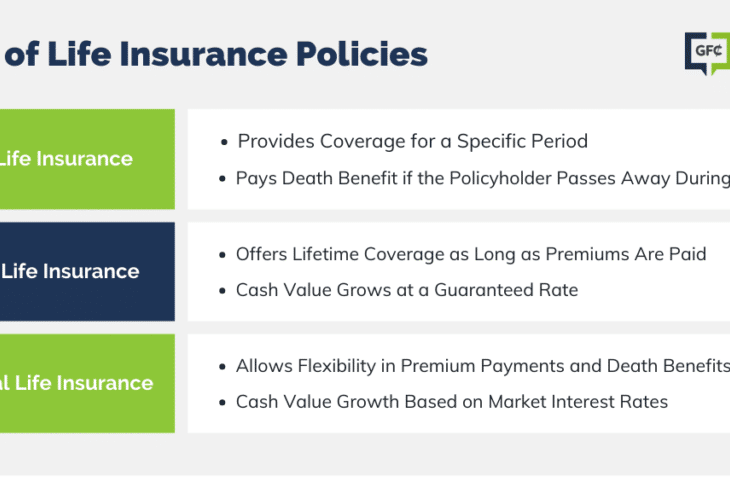

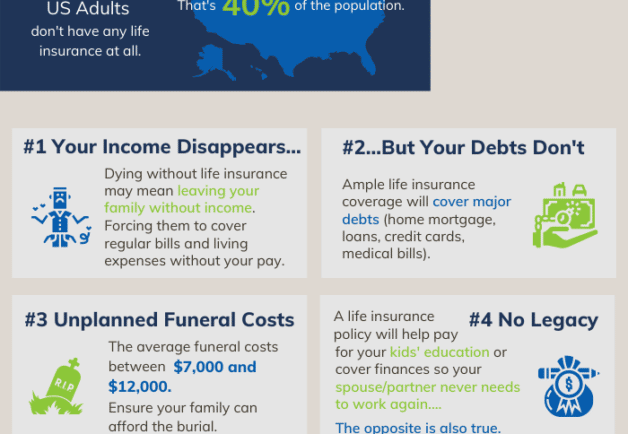

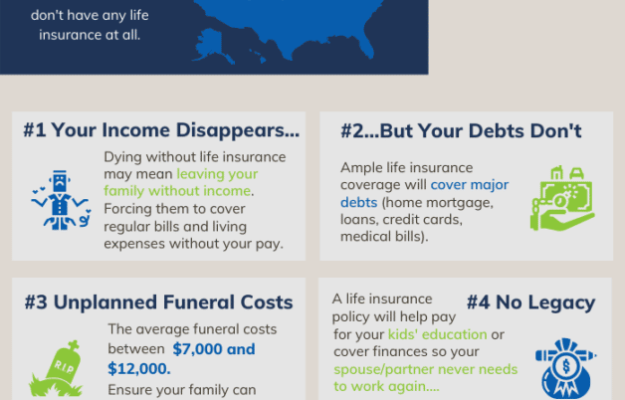

What Are the Consequences of Not Having Life Insurance?

Before I started writing in the personal finance space, I spent nearly 8 years working alongside my husband in a funeral home. My husband Greg worked as a mortician, and I was the Director of Family Services. I learned so much about living and dying […]

Insurance

by Admin

Best Homeowners Insurance Companies of 2024

The best home insurance companies offer high-quality coverage that protects against damage to your home’s structure and your property, whether it is caused by lightning, winds, fire, or other covered perils. Homeowners’ insurance also comes with important liability coverage that can save you financially if […]

Insurance

by Admin

Life Insurance With Kidney Problems

People with pre-existing conditions will find getting life insurance to be more difficult than people with a clean bill of health. Anyone with severe health complications can find that finding an affordable life insurance policy can be a long and frustrating process When you buy […]

Insurance

Issue 55 of Modern Insurance Magazine is Now Available

by Admin

In this issue of Modern Insurance Magazine, we dissect and explore this particular bond, talking with leading insurers, brokers and MGA experts about what a successful partnership looks like. To begin, Modern Insurance Magazine has collaborated with Insuramore to bring the global success of […]

Tech

In this issue of Modern Insurance Magazine, we dissect and explore this particular bond, talking with leading insurers, brokers and MGA experts about what a successful partnership looks like.

To begin, Modern Insurance Magazine has collaborated with Insuramore to bring the global success of MGAs to the fore (p.9) before moving on to interview Mike Keating of the MGAA (p.14) and David Williams from Qlaims (p.18).

As always, we also have several contributions from our in-house editorial board of industry specialists, providing their unique insight into current hot topics within the sector. Modern Insurance is also delighted to provide readers with a follow-up to ACSO’s previous series of roundtable discussions, this time with a focus on Civil Justice – particularly Alternative Dispute Resolution (ADR) and Legal Expenses Insurance (LEI) (p.41).

On p.61, you can also find a forum piece around the topic of MGAs, with input from some of the key experts within this sector including Mike Keating (MGAA), Paul Howard (AXA XL), Paul Templar (VIPR), Tim Hardcastle (INSTANDA), and Chris Butcher (Davies Group).

This issue also returns with the fourth edition of INSUR.TECH.TALK in partnership with Insurtech Insights, honing in on trailblazers from the Insurtech sector to share their astute observations in a series of interviews and editorial board musings.

To read the full issue, and to check out previous issues of the mag, follow the link here or click on the image below.

The post Issue 55 of Modern Insurance Magazine is Now Available appeared first on Lawes Consulting Group.

by Admin

Modern Insurance Magazine Issue 54 Now Available

The latest issue of Modern Insurance Magazine is now available to view, to check it out click on the image below. Welcome to yet another issue of Modern Insurance Magazine. To say that the past couple of years have been challenging to our industry would […]

TechThe latest issue of Modern Insurance Magazine is now available to view, to check it out click on the image below.

Welcome to yet another issue of Modern Insurance Magazine. To say that the past couple of years have been challenging to our industry would be a great understatement. However, the community spirit that was built throughout insurance helped everyone through those hard times. Unfortunately, as we had begun to find our feet again, we are once more facing tragedy and crises, in our nation and across Europe. As prices soar, people start rationing, prioritising one thing over another in order to put food on the table for their family. One of the expenses discarded first is often insurance, with people seeing it as a “grudge purchase” and doubting they’ll ever use it.

However, in reality, insurance serves as a financial safety net, one which is now more crucial to have than ever before. As an industry, we must tackle this issue, we must better explain to people the role and benefits of their insurance, and most importantly, we must do our best to support those in need. We need to go back to that community spirit formed over the pandemic, augment it and be certain that no one has to ever choose between financial safety and putting food on the table.

To begin, Hannah Gurga shares her insight on the next steps needed for the sector to provide maximum protection to those vulnerable (p.9). Following the success of the 2022 BIBA Conference, we speak to Steve White (p.14). Next up, Lauren Glover explains the difficulties of those digitally excluded in such a digitally controlled world (p.16).

As always, we have our resident editorial board of experts tackling the industry’s problems and focusing on what we need to be discussing right now (p.19). Our specialist forums – on Fraud and The Repairer Sector – showcase the experiences and insights from the industry’s leading experts and facilitate some great conversations (p.20; p.25).

On p.47, you can find a fascinating series of roundtable discussions on looking beyond technology in customer-driven claims solutions. Modern Insurance Magazine held these discussions in collaboration with Eddie Longworth.

This issue also includes the third edition of INSUR.TECH.TALK in partnership with Insurtech Insights, bringing together pioneers within the Insurtech sector to share their expertise in both specialist interviews and a specialist editorial board forum (p.67).

Make sure you keep up-to-date with everything Modern Insurance from news to articles and announcements via our website and Twitter @ModInsuranceMag – Until next issue, enjoy, stay safe and happy reading!

To check out other issues of Modern Insurance Magazine, click here

The post Modern Insurance Magazine Issue 54 Now Available appeared first on Lawes Consulting Group.

by Admin

Modern Insurance Magazine Issue 53 Now Available

The latest issue of Modern Insurance Magazine is now available to view, to check it out click on the image below. The insurance industry often describes itself as a ‘people industry’- citing its function is to provide peace of mind to the customer. Human beings […]

TechThe latest issue of Modern Insurance Magazine is now available to view, to check it out click on the image below.

The insurance industry often describes itself as a ‘people industry’- citing its function is to provide peace of mind to the customer. Human beings are naturally cautious of risk and it is therefore our duty to minimise that risk and help them. But what about those who populate the industry itself? Claims handlers, Brokers, Repairers, Department Heads and CEOs are all equally individual, nuanced and human. It may sound obvious but in our rapidly digitising industry, often a small reminder that there are people behind the screens with lives and experiences as vast and varied as the nature of risk itself, goes a long way.

To begin, Bernadette Dillon and Dr Sandy Caspi Sable give us their insight on inclusive leadership (page 9). To understand why a lack of diverse thinking undermines performance, we speak to Dr Juliette Bourke and Dr Andrea Titus (page 12). Next up, is an interview with the Head of People Engagement, Culture & Strategy at AXA UK, Zoe Ashdown, to find out how their policies and systems are helping to improve employee and customer engagement, while simultaneously building resilience (page 17). Finally, Modern Insurance Magazine speaks to COO, Andrew Alcock, to find out what leadership looks like at TH March, and how this has changed and impacted behaviour and culture (page 20).

As always, we have our resident editorial board of experts tackling the industry’s problems and focusing on what we need to be discussing right now (page 25). Our Wellbeing forum and Upskilling and Training Forum showcase the experiences and insights from the industry’s leading experts in the home, claims, repair, insurance, loss adjusting and tech sectors (pages 34-39 and 49-55).

In celebration of people, this issue features the 2022 UK Customer Service Excellence Awards that were held by Modern Insurance at Shaka Zulu. The night was all about celebration and recognising people for their achievements! To read about the evening, check out pages 40-46.

On a more serious note, in this issue you can also read all about the fraud discussion Modern Insurance were fortunate enough to host in collaboration with Digilog. These three Fraud Roundtables feature some of the biggest experts in the industry debating some of the most consequential crimes currently facing our industry when it comes to people (pages 63-70).

This issue also includes the second INSUR.TECH.TALK in partnership with Insurtech Insights, bringing together pioneers within the Insurtech sector to share their expertise in both specialist interviews and a specialist editorial board forum (page 81).

Make sure you keep up-to-date with everything Modern Insurance from news to articles and announcements via our website and Twitter @ModInsuranceMag – Until next issue, enjoy, stay safe and happy reading!

To check out other issues of Modern Insurance Magazine, click here

The post Modern Insurance Magazine Issue 53 Now Available appeared first on Lawes Consulting Group.

by Admin

Interview with…Glen Parker

Modern Insurance Magazine sat down with Glen Parker, Operations Director at Lawes Consulting Group, to discuss his role in the company, and his thoughts on the current landscape of insurance. What is your day-to-day like as Operations Director? What minor, everyday things must you […]

TechModern Insurance Magazine sat down with Glen Parker, Operations Director at Lawes Consulting Group, to discuss his role in the company, and his thoughts on the current landscape of insurance.

- What is your day-to-day like as Operations Director? What minor, everyday things must you make sure happen in order to ensure the smooth running of the business?

My main duty at Lawes Group is to oversee the operations of the company. My position entails different responsibilities, such as recruitment of staff, HR, Payroll and ensuring the business runs smoothly. I am always looking out for ways to improve the running of the business, and do the odd bit of recruitment, which I enjoy!

- What is your philosophy in business?

My philosophy in business is to always treat candidates and clients in the same way I would want to be treated. By this I mean have the difficult conversations with candidates as well as the good ones. Give the candidates feedback on why they went wrong in the interview, what they should be looking to do, or aim for, to make sure they nail the next interview. This is what I believe makes Lawes Consulting Group different to the rest – our dedication to the Insurance world is second to none, and our reputation mirrors that.

- How has Lawes evolved since you joined in 2008?

When I joined Lawes in 2008, it was a steady company looking to grow. I have seen Lawes grow from strength to strength in the last 14 years. Of course, I have seen staff come and go, but our aim is to increase the staff by 30% by the end of 2022. We have an expansion plan in place which we have been lucky to follow, and I personally believe we are the number one Insurance recruitment company in the UK and I am proud to be the Operations Director of such a successful business.

- What has been your proudest recruitment story while working at Lawes?

This is a very tricky question to answer, as I have many stories that I am proud of. I have helped so many candidates find jobs, and likewise helped many clients find the right staff. I would say, the proudest thing for me has been helping individuals who unfortunately have found themselves out of work due to the COVID-19 pandemic, or any other reason that is no fault of their own. This has given me the most pleasure while working at Lawes.

- How did you personally have to adapt in your strategic approach over the pandemic?

At first everything was new; it was 30 degrees outside in the first lockdown and no-one really knew what was happening, so we took everything in our stride. We used the time to evaluate, and decided that now would be the best time to upgrade all of our systems and technology, including all of our IT equipment and telecoms. Most clients stopped recruiting for a short period of time, but we got our heads down and decided to get used to the new way of recruiting. Who would have thought clients would be ready to take on staff just over a zoom meeting? I personally think it has changed the recruitment industry massively and I can’t see it stopping!

- What excites you the most about the current market?

What excites me the most with the current market is that more and more clients are getting used to home working or hybrid working. What this means for the clients is that they will have a much larger candidate pool to choose from when looking to fill a position.

Glen Parker | Operations Director | Lawes Consulting Group

The post Interview with…Glen Parker appeared first on Lawes Consulting Group.

by Admin

Flock selects AutoRek for Bordereau, Bank & Payment Reconciliation Requirements

London, 26 January – AutoRek, a leading software provider to global financial services firms, is pleased to welcome Flock on board as a new client. Flock was founded on the conviction that traditional insurance business models are no longer fit for purpose in our fast-moving, […]

TechLondon, 26 January – AutoRek, a leading software provider to global financial services firms, is pleased to welcome Flock on board as a new client.

Flock was founded on the conviction that traditional insurance business models are no longer fit for purpose in our fast-moving, hyper-connected world. They set out to change this by building a global, fully digital insurance company for connected commercial vehicles. An insurance company that proactively mitigates risk, rather than just paying claims.

In 2016, Flock emerged from academia as research into real-time risk analysis for connected and autonomous vehicles. The company now insures tens of thousands of commercial vehicles for leading fleets including Jaguar, Land Rover’s The Out and Virtuo. Driven by a mission to make the world a smarter, safer place, Flock believes the insurer of the future won’t just pay claims but will actively help its customers improve safety.

AutoRek’s solution was chosen by Flock due its flexibility. As the company continues to grow at pace, it was crucial that it found a tech partner that could support its ambitious growth.

AutoRek are delighted to partner with Flock as another delegated authority insurance intermediary client, who will be using AutoRek to:

- Automate bordereau, bank and payment reconciliation requirements

- Calculate broker payments to generate statements to brokers and paid bordereau

- Take various external data sources from other insurance organisations, as well as from the general ledger

- Underpin Flock’s Insurance Broker Accounting (IBA) operations

Gordon McHarg, CEO at AutoRek, added, “It is excellent to have Flock come on board as a new client. We are delighted to be seen as a flexible and adaptable tool to help fast-growing companies like Flock scale their business. We look forward to continuing this partnership over the coming years.”

Piers Williams, Insurance Lead at AutoRek, added, “We are excited to work with Flock, they are disrupting the insurance industry with innovative new products. Behind their exciting business is a foundation of leading software solutions that are enabling the business to achieve its objectives. Flock will be deploying AutoRek’s bordereau reconciliation and financial control solution to deliver end-to-end automation.”

The post Flock selects AutoRek for Bordereau, Bank & Payment Reconciliation Requirements appeared first on Lawes Consulting Group.

by Admin

Roundtable event shines a spotlight on salvage

Copy provided by e2e Total Loss Vehicle Management Experts from across the insurance industry met late in 2021 to consider the perennial – and one of the most pressing issues facing the sector at the moment – total loss vehicle management. Despite around one […]

TechCopy provided by e2e Total Loss Vehicle Management

Experts from across the insurance industry met late in 2021 to consider the perennial – and one of the most pressing issues facing the sector at the moment – total loss vehicle management. Despite around one fifth of all damaged vehicles ending up as total losses, it’s an often-obtuse area of the motor claims continuum.

The meeting asked attendees to consider the view that an opportunity exists to more effectively tap into total loss and end of life vehicle stock to create alternative sources of parts for the benefit of insurers, customers, repairers and the wider environment.

Timely

The timely event was hosted by I Love Claims (ILC) in association with e2e Total Loss Vehicle Management with the far-reaching discussion addressing everything from industry and customer attitudes to salvage and reclaimed parts; to the ethical question of value and price – via the benefits of better linking salvage and repair processes; to legislation; and whether cross industry co-operation would help to realise opportunities.

Taking part in the discussions were:

- Andrew Ridley, Commercial Manager, DLG

- Trevor Webb, Claims Director, Sabre

- Adam Murray, Motor Technical Manager, Aviva

- Nicholas Rossiter, Motor Damage Strategy Manager, Allianz

- Chris Morgan, Director, ASM

- Mia Constable, Head of Business Development, e2e Total Loss Vehicle Management

- and Neil Joslin, the then chief operating officer, e2e Total Loss Vehicle Management

all of whom shared their insights in an open, transparent environment with the objective of contributing to an improved collective industry understanding of the issues and opportunities.

Reputational challenges

The management of salvage and total losses features opportunities and challenges, but too often it has been disregarded at a strategic level and consequently labelled ‘dysfunctional’ at a tactical level.

The current context is that insurance policies and marketing only really address repair as the outcome of a claim.

However, a significant number of vehicles are written off and customers who wish to preserve their vehicle can find the process a minefield once economic write-off levels are reached on a repair.

Seemingly, few policies address the options available apart from talking about the potential for using non-OE and reclaimed OE parts.

Thought to be contributory to this context, the meeting addressed the ‘dirty’ image of the salvage industry and explained how this is now a wholly inaccurate impression. Representatives from e2e added, that in their experience, salvage does not receive the same attention from the leadership of insurers and in their supply chain teams as does legal or loss adjusting; despite its revenue generation being second only to premium income for motor insurers.

Fundamental shifts

To overcome this, the industry will have to make fundamental technological and philosophical shifts – some are known now and some will only be revealed as new tech comes onboard.

It was thought that barriers include both ‘soft’ attitudinal and ‘hard’ process issues. In the past these have combined to restrict investment in the insurer/salvage interface.

Perhaps the first step is a change in approach to managing salvage and repair. For too long they have been considered independent of each other, operating in silos. Arguably, this has created inefficiencies in the process and wastage – especially around the opportunity afforded by recycled parts. It was recognised that once classed as a total loss the momentum of a claim rarely allows reconsideration of the vehicle’s status by imaginatively considering the repair method and use of alternative parts.

Attendees agreed that it was critical to start thinking like customers – whose desired outcome is namely to have their personal mobility restored – and see repair and salvage as complimentary parts of the same process rather than two different types of claim.

This sort of ‘new thinking’ it was suggested, could, if fully developed even result in entire business models transforming, with repairers evolving to include dismantling and salvage operators becoming waste managers or recyclers.

In the meantime, the assembled agreed that closer links between repair and salvage with a more deliberate strategy of total loss avoidance could be a benefit to all.

Reclaimed parts

A new joined-up approach would logically, if applied correctly, see greater numbers of reclaimed parts stripped from total losses re-entering the market.

It was suggested the UK lags behind other developed markets in this area, with historical concerns about stock availability being a perceived stumbling block. Several large insurers are embracing the use of reclaimed parts but others are not confident that they could consistently access the stock in what one described as an ‘embryonic’ sector.

The representatives of e2e were keen that this perception is addressed as the salvage and recycled parts industry has moved on from when these concerns were first articulated. Huge investments have been made in the supply chain which is allowing several insurers to confidently take advantage of the opportunities.

Consumer appetite

Those in attendance agreed that consumer appetite for green initiatives was growing. However, there is a seeming lack of confidence in marketing ‘green motor policies’ at present. Reclaimed parts cannot be used in all circumstances and as such, ‘green-labelled’ products could falsely raise customer expectations. There is also the potential challenge for demand to outstrip supply.

However, with many motor policy wordings allowing for the use of ‘alternative parts’, there seems sufficient capacity in the sector to allow reclaimed parts to become 10-20% of the parts used in repairing vehicles.

Considerations such as the vehicles being repaired are ‘often younger than the parts being made available’ and that reclaimed parts can only be used on non-safety related components will always see a natural restriction in the proportion of reclaimed parts use.

As an important step into the future, attendees called for greater consistency around the description of reclaimed parts, suggesting also that a review and update of the Salvage Code of Practice might bring more transparency and reassurance to the market. For example, attendees pointed out that, at the moment, there is no audit trail for Category S vehicles and the question was raised: “is there actually an industry benefit in them being stripped to boost reclaimed parts stock?”

Repair cost inflation

Profitability in the insurance market is founded in the delicate balance between premium and claim cost. The motor insurance market has rarely made an underwriting profit in the last decade. It was suggested that customers react to any slight change in premiums, meaning insurers have traditionally been reluctant to try new practices for fear of disturbing the balance.

However, there are two new market influences being felt in 2021/22. The first is high repair cost inflation and the second is evidence that customers are more willing to pay a premium for products from companies exhibiting sustainable and/or ethical trading policies.

With insurance being a commodity it is unlikely consumers will enact on this principle until it is more established in other sectors and markets. However, a better presentation of the environmental efforts of insurers, including the treatment of salvage, would only assist customers in their purchase considerations

The meeting discussed that a strategy of repair over replace created to combat cost inflation could also help demonstrate sustainable credentials. To provide transparency and choice for the customer, insurers could also consider changes in processes for example the creation of optional policy pricing models ie with reclaimed parts and without.

Thinking differently

The use of reclaimed parts, although important and potentially highly beneficial, is just one solution with many of the longer term answers still to be identified. The good news is that insurers are in the right frame of mind to discover them and those represented at the roundtable said their company recognised that yesterday’s data would not inform tomorrow’s experience and had thus created teams to scan the horizon for innovations.

They said much of the focus is, of course, on new technologies such as electric vehicles and ADAS, while they are also considering new materials used in vehicle construction and appropriate repair methods, with the challenge being forecasting the impact on frequency of incident and cost of repair.

Insurers are also grappling with the impacts of the changing ownership models.

Industry-wide action

Progressive insurance companies are already seeking and introducing their own initiatives in-light of the investments made in the reclaimed parts supply chain and the meeting went on to consider whether an industry-wide approach to some aspects of salvage would be useful and benefit all parties.

The debate highlighted the different experiences and perspectives within the sector, but all agreed that in a highly price-sensitive and competitive market, change would unlikely be embraced uniformly. Perhaps therefore, regulators and trade bodies should be in the vanguard of thinking about this developing trend in motor claims resolution.

One attendee said, “There are solutions out there, but they cannot be enforced across the piece from manufacturers, through insurers, into the repair and salvage supply chains. So cross-industry change could be desirable.”

Whilst the UK government is setting the standard in some areas of automotive development, it was suggested it has fallen far behind other countries in end-of-life recycling. Attendees said lessons need to be learned from other markets around the regulation necessary to develop best practice.

Future

As this aspect of how industry practice develops, the meeting was unanimous in calling for staff and organisational training to keep pace. The lack of focus on upskilling to keep pace with technology has been, according to one attendee, ‘appalling’ for some time and while many operators will claim the capability to adequately service the accident repair market now, it will be a huge challenge to maintain and develop the required capability in future.

“Technology is moving way too fast for the sector. We say we can handle new technologies such as EVs, but the reality is very different,” a participant argued.

In summary, the meeting concluded that to keep up, it was clear to all that amongst a long list of improvements and changes required in claims process and claims outcome management, one key improvement was for salvage and repair to coalesce into a more integrated process. A process with service, safety, sustainability, claims cost control and efficiency built in for and by all parties involved in the journey.

The discussion was chaired by Darren Wills, Executive Director, Motofix, who was representing ILC on the day.

The post Roundtable event shines a spotlight on salvage appeared first on Lawes Consulting Group.

by Admin

Solving subsidence using pioneering technology

As many property owners and insurance professionals will agree, subsidence of a property is devastating news for the owner. Levelling a sloping, uneven building is traditionally an intrusive and time-consuming process that can carry a hefty price tag for both claimants and insurance companies. However, […]

ClaimsAs many property owners and insurance professionals will agree, subsidence of a property is devastating news for the owner. Levelling a sloping, uneven building is traditionally an intrusive and time-consuming process that can carry a hefty price tag for both claimants and insurance companies. However, with advances in technology, traditional underpinning methods are no longer the only option and instead insurers and loss adjusters can collaboratively adopt a technology led, injection solution that requires little to no excavation, creates minimal mess, is extremely accurate and often allows the occupants to reside in the property while the work is carried out.

What is injection technology?

Historically, ground engineering solutions haven’t been the most cost-effective option for both property owners and insurance companies. What’s more, due to the invasive nature of traditional methods, as well as the inconvenience caused by these processes, it’s often the last resort. However, advances in new technology means that expensive and inconvenient methods are now a thing of the past, with injection processes becoming a far more viable solution. It’s now possible for home owners, insurance companies and loss adjusters to use non-invasive methods to raise and strengthen a building. For example, Mainmark offers two non-invasive injection solutions including Teretek®, engineered resin injection and JOG Computer-Controlled Grouting, which delivers a high mobility cementitious grout mix to a multitude of injection ports under precise computer control. The JOG computers control the grout monitors, injecting every few seconds to gently and precisely raise, or “float”, the entire structure back to level.

This advancement in technology is a real game changer when it comes to policy claims, as it allows the loss adjuster to offer a far quicker and reliable solution that is financially beneficial for both parties. What’s more, these new advanced solutions remove the insurer’s responsibility to provide alternative accommodation for the claimant, as the homeowner can remain in their property whilst the work is carried out. Not only does this simplify the claim process but it also enables the insurance company the save money, as alternative accommodation can often end up costing more than the remedial ground work itself.

So, how does this work in practice?

Recently, Mainmark came to the assistance of a Macclesfield homeowner, whose two-story brick house had started to subside by as much as 82mm. The homeowner was hoping to renovate the property but needed to fix the structural issues beforehand. There were a number of options considered by the homeowner including traditional underpinning. However, not only would that have simply stabilised the property and not lifted and re-levelled, it would have taken a prolonged period of time. Due to the tight timeframe as well as the cost and disruption associated with those methods, the homeowner decided to appoint Mainmark and utilise their computer-controlled injection process. This solution allowed the homeowner to continue with his renovations in a timely manner and helped prevent future subsidence issues, as the material used in Mainmark’s JOG process strengthens the foundation ground whilst lifting and re-levelling.

The Mainmark team faced a number of obstacles during this job including the amount the house was sloping; the entire 64m2 structure needed to be lifted. Adding to the challenge, the Mainmark engineers had to carry out the work with limited site access due to the narrow, shared driveway, however, because JOG equipment is self-contained it reduces the ‘site footprint’ and allows for easy access. Furthermore, because of the renovations that were due to take place, Mainmark was tasked to complete the project within a five-day timeframe. Using Mainmark’s proprietary technology, the engineers were able to complete the job in less than five days, achieving a maximum differential of just 6mm across the entire area of the house.

This example clearly indicates the capabilities of modern technology and how it can completely transform the claims process both for insurance professionals and property owners.

If you would like to talk to Chris Charman at Mainmark, CLICK HERE, leave a message and youTalk-insurance will pass your enquiry on.

Tags:

Hidden Image:

by Admin

Insurance fraud crime and punishment – The sentences are too light

“The whole question here is: am I a monster, or a victim myself?” Fyodor Dostoyevsky, Crime and Punishment Tough on crime, tough on the causes of crime was a rallying call to treat the symptoms of criminal – often violent – activity that threatened a civil […]

Claims“The whole question here is: am I a monster, or a victim myself?”

Fyodor Dostoyevsky, Crime and Punishment

Tough on crime, tough on the causes of crime was a rallying call to treat the symptoms of criminal – often violent – activity that threatened a civil breakdown in society more than a decade ago. Recently released crime figures have been a sobering reminder that we have some way to go before we adequately treat the causes.

So, in this blog I want to ask two questions: “Have we forgotten about the victims?” More precisely, I am referring to the victims of insurance fraud whose number are spiralling out of control. The other question I want to ask is: “Why do the fraudsters do it?” and could that knowledge inform our response to understanding the causes and mitigating the threat?

Despite the increased public awareness, more modern types of insurance fraud still show no signs of abating with fraudsters inventing ever more sophisticated scams. In 2016 the ABI reported that UK insurers detected 125,000 dishonest insurance claims valued at £1.3 billion. Undetected insurance fraud is said to cost the UK economy circa £2 billion per annum.

Whilst this figure was 5% down on the previous year, the deterrent of detection leading to a possible criminal conviction doesn’t seem to be dissuading the less conscientious members of society. That’s why I want to make a case for stiffer sentences, a campaign to turn words into action and make a case for the victims of insurance fraud.

Insurance fraud has always existed

In a galaxy far far away, or at least when I was a nipper just starting out on my insurance journey, insurance fraud occurred. Yes, it’s not a new invention, pesky fraudsters even plied their nasty trade even back then.

An epigram by the Roman poet, Martial provides evidence the phenomenon of insurance fraud was already known in the Roman Empire during the First Century AD.

"Tongilianus, you paid two hundred for your house;

An accident too common in this city destroyed it.

You collected ten times more. Doesn't it seem, I pray,

That you set fire to your own house, Tongilianus?"

Book III, No. 52

Whilst insurers knew it was going on, the prevailing historic zeitgeist was to address it in the front room with window curtains firmly drawn. Looking back, I can think of several instances in my early career where the fraudulent policyholder was simply told ‘this claim in fraudulent, we’re not paying it and we’re cancelling your policy ab initio'.

The fraudster policyholder would inevitably go skulking off into the sunset never to be heard of again and most importantly the insurer would have dealt with the issue without washing its dirty laundry in public for fear of adverse publicity.

So it’s nothing new. In fact, it would be fair to say that insurance fraudsters, if my CII studies are correct (and they may not be – it was a long time ago now), played a central role in development of the concept of ‘insurable interest’, that was codified in the Life Assurance Act 1774.

I guess it will remain a universal truth that as long as a person or a business has something that somebody else wants, criminals will be hell bent on inventing ever more devious scams aimed at snaffling stuff.

Great to see the industry has come a long long way

I had a cold a few weeks ago which I suspected was Man-Flu, so like all good patients I took to my bed, took virtually every over the counter drug imaginable and thought I’d give day time TV a go.

First up was a programme called ‘Claimed and Shamed’ on the BBC presented by the hip swirling Ore Oduba of Strictly Come Dancing fame. What a fascinating watch (check it out on iPlayer).

If you haven’t seen it, Ore basically covers off a few insurance fraud detection stories that include Oscar winning performances from members of the insurance profession that inevitably culminate in pesky fraudsters being caught and justice being seen to be done (well sort of).

I say ‘well sort of’ because despite the sterling work that is being done by the Insurance Fraud Taskforce, the Insurance Fraud Enforcement Department, The ABI, insurers and BIBA, when insurance fraudsters are tracked down and prosecuted the sentences they receive seem woefully inadequate.

The court sentences are not working

Over the last year www.youTalk-insurance.com has covered numerous insurance fraud prosecution stories that point to the fact that sentences are too light.

The sample of stories shown below sadly feature the recurring word ‘SUSPENDED’

– Man sentenced after he made 13 false insurance claims – Suspended sentence

– Man sentenced for making false insurance claims worth over £40,000 – Suspended sentence

– Woman who made false injury claim then did bungee jump on TV is sentenced – Suspended sentence

– Woman sentenced after falsely claiming her business premises had flooded – Suspended sentence

– Deed poll fraudster sentenced for making false car insurance claims – Suspended sentence

I could go on, but I think you get my point – Sentences are inadequate and not deterring criminals

The one area where there seems to be a glimmer of light relates to ‘crash for cash’. My ‘bar room lawyer’ assessment is that this might be due to the fact that in such cases the criminals involved are putting lives and limbs are risk in their pursuit of a pecuniary gain but even here not enough is being done.

Organised gangs are staging car crashes to commit insurance fraud. As part of a national scam worth roughly £340m a year, criminals are orchestrating accidents to make fraudulent insurance claims, the profits of which are used to fund other crimes, including illegal firearms and drug smuggling. As honest policyholders we pick up a collective bill for fraud through increased premiums.

Fraud Hotspots

It is estimated that a staggering one in seven personal injury claims are linked to crash for cash frauds, and that figure could be the tip of the iceberg. An analysis of crime statistics reveals there are also problem hotspots in certain parts of the country. Birmingham is at the top of the list, with six of the top 10 postcodes that have been linked with the crime. Bradford is another troubled area with postcodes on the list, as well as Bolton. Other places that appear on an enlarged 20-strong hotspots list include Halifax, Manchester, Enfield, Ilford, London and Liverpool.

According to the ABI these scams have already had fatal consequences.

A 34-year-old woman was killed after she was struck by a van moments after being involved in a deliberate collision orchestrated by a gang. The men responsible for the crash were each jailed for 10 years. Even so, a depressing 8% of people would still consider taking part in a crash for cash scam in order to gain financially, according to shocking statistics published by the Insurance Fraud Bureau.

The compensation culture we have is being blamed for the rising tide of fraudulent claims. Insurance giant Aviva examined its own data on whiplash and found that 94% of all personal injury motor claims it had paid were for minor injuries such as short-term whiplash. In France, this figure is estimated to be around 3%.

Hang ‘em High?

Without sounding like a ‘Hang ‘em high Judge’, I think it’s about time our legislators and politicians grabbed hold of this issue and perhaps in doing so make reference to the Sentencing Council’s guidelines for the crime of theft.

The subject of appropriate sentencing for insurance fraud does not need an existential Dostoyevsky-esque driven philosophical debate. The facts are quite simple and plain to see. With 125,000 dishonest insurance claims the issue has reached epidemic proportions and notwithstanding the great work being done to address the issue the obvious chink in the whole process is sentencing. Let’s send more insurance fraudsters to jail and publicise the fact.

The underlying issue is more nuanced, however, than sentencing and as always it comes down to changing attitudes and education, addressing the causes. We send police officers, ex cons and victims of accidents into schools to talk about crime prevention so why not do the same for insurance fraud victims? If eight percent of people would consider taking part in a crash for cash what does that say about our society. Let’s say that the average person has an extended family and circle of friends of around 30 to 40 people. You do the maths…

This is a problem that goes way beyond insurance. As an industry and society we have to do our best to make sure that crime doesn’t pay, that punishment is just, and above and beyond that we need to address the causes, the fraudsters’ motives.

Tags:

Hidden Image:

by Admin

Don’t Keep up with the Kardashians’ – Social Media – Don’t make it easy for thieves

The omni-present Kardashian family are well known for being relentless trend-setters; however the aggravated robbery of Kim Kardashian last October was one trend we would rather not keep up with. Unfortunately, the scary fact is that this high profile robbery does reflect something we’ve witnessed […]

ClaimsThe omni-present Kardashian family are well known for being relentless trend-setters; however the aggravated robbery of Kim Kardashian last October was one trend we would rather not keep up with.

Unfortunately, the scary fact is that this high profile robbery does reflect something we’ve witnessed here at Covéa Insurance. In the past five years I’ve seen significant increase in the number of aggravated burglaries, particularly of HNW properties, which can leave customers severely traumatised and suffering from physical injury.

As with the Kardashian ‘Kase’, social media is known to play a large part in the increase in these types of claim, and this trend is likely to continue as we live more of our lives online. This week, as the clocks go back and the evenings draw in, the risk of falling victim to burglary only increases so I wanted to share some simple practical advice on how to increase your own personal safety, particularly if, like America’s ‘other’ first family, you spend a lot of time on social media.

We’re used to sharing so many aspects of our lives on social media; photos of our houses, gardens, expensive new purchases and holidays are splashed all over Facebook, Twitter and Instagram, but we rarely think about how this information could be used against us. All it takes is for the wrong person to see a picture of your fancy new car, combined with some geographical clues from the geo-tagging function of an app and they can work out where you live, and more worryingly, whether you might be at home, based on where you’ve tagged yourself.

Our behaviour on social media can make a huge difference to the risk of being targeted and I’d offer customers the following advice:

Regularly review and check your privacy settings, Facebook’s privacy settings can be confusing but it’s worth taking the time to understand them to ensure that only people you trust can view your pictures. Twitter and Instagram are much easier to control, you can make your profile private, meaning that only people you’ve approved to follow you can see what you post.

Avoid the urge to ‘tag’ yourself when you’re out of the house for any length of time, particularly if you’re going on holiday, it’s a clear signal to burglars that your house is vacant.

Avoid posting pictures of expensive items such as watches or jewels, these visible displays of wealth can make customers a target both within and outside their homes – this is especially pertinent with Christmas around the corner, be careful about showing off your expensive presents on social media and bear in mind that the packages you leave out for recycling on Boxing Day give passersby a window into the valuable new items that are sitting in your living room.

We know that high net worth customers are more likely to be victim of such attacks, so we have a number of covers in place on our Executive Home and Executive Plus products that provide additional protection and reassurance to customers’ which include:

- Private counselling

- Cover for necessary security improvements to the home after an incident or assistance on the cost of fees for moving home if the customer decides they can no longer stay in the property

- Cover for alternative accommodation following the incident if necessary

- Cover for ransom demands

- A dedicated Executive Claims Manager like myself who will look after the customer from the first phone call to the last.

Thankfully aggravated burglaries are still rare, but it’s always worth ensuring that we’re minimising the risk as much as possible, after all; Keeping up with the Kardashians is just a TV show, not an aspiration!

Tags:

Hidden Image:

Description:

Steve Godbold, External Claim Operations Manager for Covéa Insurance shares some useful advice for insurance policyholders about the pitfalls of using social media and how providing too much personal information can make it easier for thieves

by Admin

Future-proofing household insurance claims service

Against a constantly changing claims landscape, insurers must offer services that meet their customers' needs and expectations. As a result, and following an extensive review, Allianz is proposing to combine its commercial and household claims units to create one property claims team in Milton Keynes. […]

ClaimsAgainst a constantly changing claims landscape, insurers must offer services that meet their customers' needs and expectations. As a result, and following an extensive review, Allianz is proposing to combine its commercial and household claims units to create one property claims team in Milton Keynes.

Our review showed there were clear strengths and opportunities in doing this, enabling our customers to benefit from a claims service that suits their requirements, whatever the future brings.

The pace of change in the claims arena certainly requires insurers to look to the future. Technology such as online claims services and claim tracking has already delivered benefits to customers and the next wave of digital solutions will take this further still.

For instance, in tomorrow's more connected world, your car could liaise with your digital personal assistant, your insurer's claims department and the local garage to arrange repairs following a crash.

Similarly, if you're living in a connected home, you, and your claims team, will know the second there's a leak or something's overheating. Forewarned, steps could then be taken to avoid further damage and cost.

Alongside the arrival of smarter technology, customers' expectations are also evolving. They appreciate the slick customer service delivered by the likes of Amazon and Apple, and they now expect it from more traditional companies.

As well as the delays to the proposed whiplash reforms, the review to the discount rate continues to rumble on and, with the political landscape also unsteady, who knows what Brexit may bring. Add to this a hung Parliament and you have all the ingredients for an uncertain future!

Given all these factors, insurers must continually evolve to ensure they deliver the service and propositions that are right for their customers. Co-locating our commercial and household claims teams in Milton Keynes is a good example of this.

Strong synergies between the customer journey, systems and supply chain for SME and individual property claims means it makes sense to bring the two teams together. Having them in the same location enables us to fully align our processes and procedures and deliver a single, robust customer journey.

Milton Keynes is also home to our casualty claims team. As our customers often purchase property and casualty insurance together, it's logical to have the claims operations in the same place. Where a customer’s requirements overlap, within the two areas, it can be dealt with efficiently and in a seamless manner.

Developing claims services that exceed customer expectations is essential in today's increasingly competitive and constantly changing market. The proposal to bring our property claims teams together will ensure we maintain our reputation for excellent claims service well into the future.

If you would like to get in contact with Graham Gibson about the issues raised in this blog Click Here

Tags:

Related Insurer or Professional Body:

Hidden Image:

Description:

Allianz insurance head of claims Graham Gibson explains Allianz's proposed review to combine its commercial and household insurance claims units to create one property claims team based in Milton Keynes.