by Admin

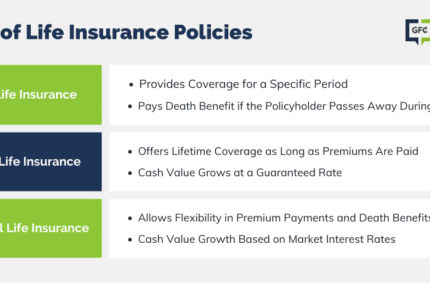

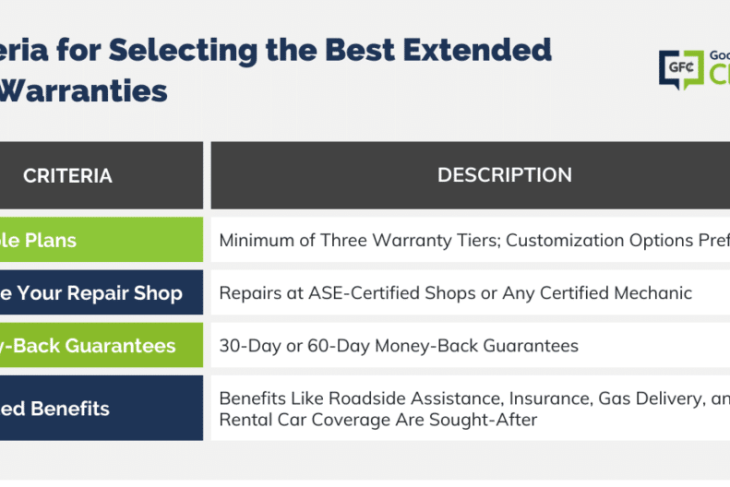

Best Extended Car Warranty for 2024

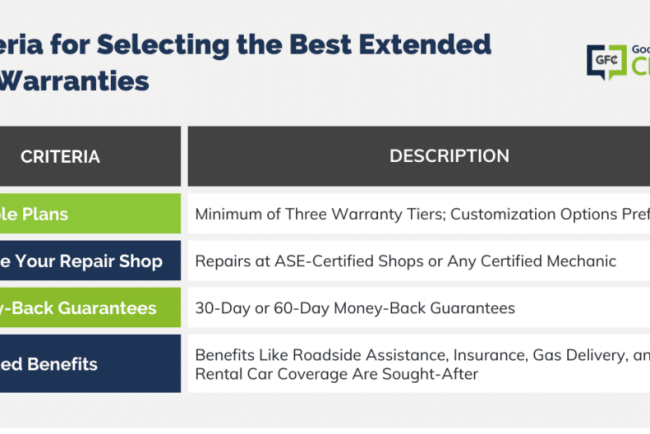

Shopping for an extended car warranty may not sound very fun, but having this protection can provide considerable peace of mind. After all, the best-extended car warranties can ensure your car gets fixed during a covered breakdown. Best of all, your extended warranty coverage will […]

Insurance

by Admin

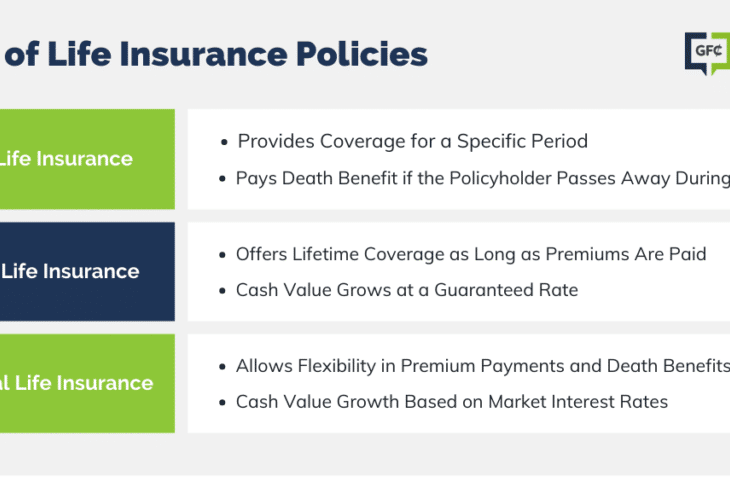

Ladder Life Insurance Review – Term Life Insurance With a Twist

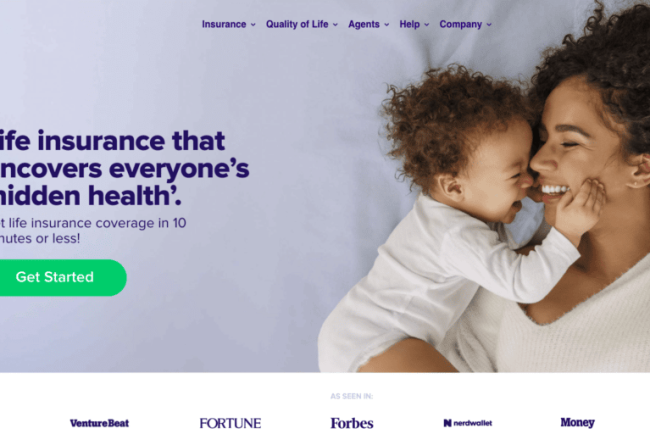

If you’re looking for an affordable term life insurance policy that you can obtain quickly, you need to check out Ladder. Their streamlined online application can have you approved in a matter of minutes. And according to Ladder, many applications are approved without a medical […]

Insurance

by Admin

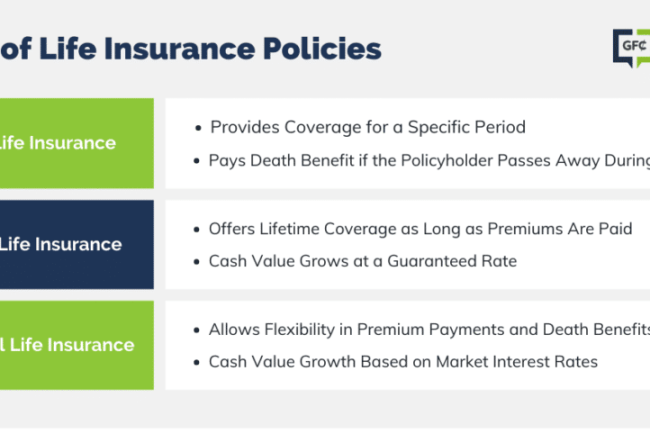

Sproutt Life Insurance Review: Is it Legit?

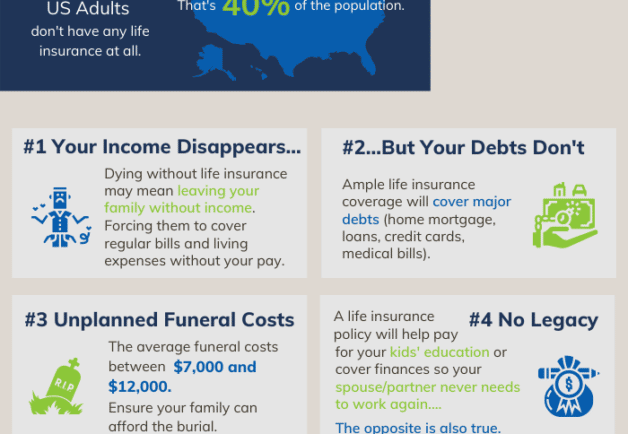

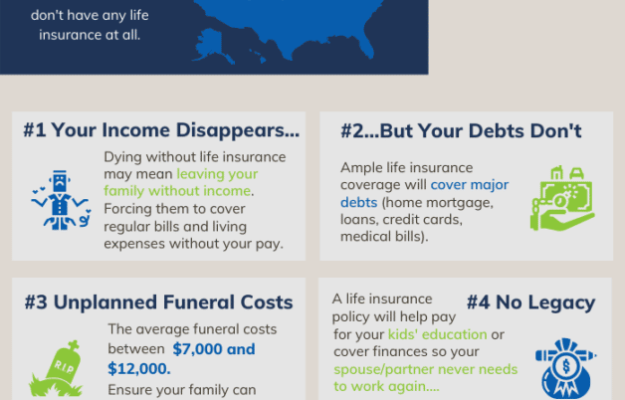

The vast majority of Americans need life insurance. But with so many different insurance policies and providers, how can you find the right life insurance policy for you and your family? Sproutt Insurance is trying to help by putting a unique spin on the insurance […]

Insurance

The Loss Experience

by Admin

I remember sitting next to the head of a major broking house not that long ago and we were discussing how surprising it was that the Gulf of Mexico hadn’t experienced a major hurricane since 2008, which then led onto a discussion of the frequency […]

ClaimsI remember sitting next to the head of a major broking house not that long ago and we were discussing how surprising it was that the Gulf of Mexico hadn’t experienced a major hurricane since 2008, which then led onto a discussion of the frequency of major claims.

The line that really stood out for me was: “there will always be unexpected claims”. As if to prove his point, only a few weeks later the (re)insurance market was hit by the decidedly unexpected super storm Sandy, one of the latest forming major US storms to cause substantive damage in recent memory.

I’m writing about this because in recent days here in the UK market we’ve once again been given a terrible reminder of just how unexpected some claims can be. The shocking crash of a police helicopter into a popular Glasgow pub on 29 November, late on a Friday night, must register in anyone’s mind as a galling tragedy and our thoughts and prayers are with all those affected by such a peculiar disaster.

Two days later we had another costly reminder of unexpected claims with the train crash in the Bronx area of New York in which four people were killed and more than 60 injured. The 5:54 from Poughkeepsie to Grand Central Station derailed as it went into a bend in the railway line near Spuyten Duyvil station.

One is never immune to the human cost of such tragedies, of course, but as a market, whether broker, underwriter or claims professional, we have to learn to expect for and model such non-standard risks, whether they come from the aviation, rail or other specialised markets. At Russell this is very much our space, operating outside of traditional risk management boundaries and taking the best from modern risk modeling techniques.

The Glasgow helicopter crash here and the New York railway crash are brutal and costly reminders that as a wider (re)insurance market we need to continue to think outside of standard claims.

Tags:

Hidden Image:

Description:

Suki Basi, Managing Director, Russell Group – Guest blog on youTalk-insurance – The Loss Experience

by Admin

Deferred prosecution agreements – Directors being hung out to dry?

Deferred Prosecution Agreements ("DPA") have been used in the United States for many years. DPAs allow companies to take certain steps (either by way of reparation or ensuring that certain offences are not repeated) during a supervisory period and the trade off is that the […]

ClaimsDeferred Prosecution Agreements ("DPA") have been used in the United States for many years. DPAs allow companies to take certain steps (either by way of reparation or ensuring that certain offences are not repeated) during a supervisory period and the trade off is that the company and/or the directors will not be prosecuted. Following the expiry of this period no further action is taken. DPAs are now to be found in UK law in Schedule 17 of the Crime and Courts Act 2013 ("CCA 2013"), although as of this date this Schedule is still not yet in force.

DPA's envisages either the Director of Public Prosecutions or the Serious Fraud Office taking action against corporate bodies and in doing so will consider (amongst other matters) the following:

- The nature and seriousness of the offence

- The breadth of the wrongdoing

- The seniority of the individuals involved in the wrongdoing

- Any losses to third parties

Unlike in the United States, the judicial authorities will have oversight of the procedure and will therefore be required to review and approve any such "deals".

So, what does this mean for directors and officers? In the United States directors and officers are included in a DPA. In the UK directors and officers cannot be part of a DPA.

Therefore, it is conceivable that a company will plead guilty to various misdemeanours and be required to take restorative/reparatory steps, but that directors and officers will not receive the benefit of these concessions. Thus, directors and officers may well be placed in an invidious position whereby a company pleads guilty to certain offences (some of which may be caught by the Financial Services and Markets Act 2000) and not receive the benefit of any DPA and yet may be prosecuted on the basis of the company's plea.

Directors and officers would face an uphill struggle when seeking to show that they are not guilty of the offences to which the company had pleaded guilty. And another possibility – whilst the directors may be the controlling minds of the company, if they fail to enter into a DPA (which might benefit the company) then might the shareholders have a view as to the benefit of a DPA?

Whilst the suggestion is that there will be approximately 10 DPAs entered into per annum (it is not clear where this figure comes from), nevertheless the potential liabilities for directors and officers would appear to be significantly exacerbated.

Tags:

Hidden Image:

by Admin

Never Mind The ‘Elf and Safety', It’s the brand, stupid!

What recent parliamentary Act has “the potential to be the most significant piece of legislation for health and safety law in 40 years”? In an article I recently read by Helen Grimberg of law firm Berrymans Lace Mawer, it’s the recently adopted Enterprise and Regulatory […]

ClaimsWhat recent parliamentary Act has “the potential to be the most significant piece of legislation for health and safety law in 40 years”?

In an article I recently read by Helen Grimberg of law firm Berrymans Lace Mawer, it’s the recently adopted Enterprise and Regulatory Reform Act 2013.

According to Grimberg, the act “Once implemented, it will allow for the removal of strict liability, in civil claims, for breaches of certain health and saftey regulations”

In terms of what the Act means for businesses, the Department for Business Innovation and Skills (DBIS) claims it will “cut the costs of doing business in Britain, boosting consumer and business confidence and helping the private sector create jobs.” Various elements of the Act, such as employment tribunals and reducing red tape, are designed to help UK business and support them directly.

Bureaucratic guff? Actually, I believe the intention is to help businesses by limiting the right to claim for compensation where it can be proved an employer has acted negligently.

This means in future, if a claim is made, the employer will have the opportunity to defend themselves on the basis of having taken reasonable steps to reduce the risk of an accident – or in the words of DBIS “providing this reassurance will help businesses have the confidence to focus on managing health and safety risks in a sensible and proportionate way.”

From a claims perspective it is still too early to say what impact this change might have on the number and the success rate of claims that defendants may face but one consequence is clear: there will likely be more work in claims handling than at present.

Let’s not become carried away here. I would be surprised if risk management teams in the UK’s business community fundamentally change their approach to health and safety and risk prevention. While breaches of health and safety are a favourite cause of mirth for comedians entertaining crowds on the stand up comedy circuit, they are no laughing matter for CEO’s and FD’s who are obligated to protect their businesses reputations and brands, as well as their employees’ safety.

In today’s world of 24/7 instant online media reporting, a breach of health and safety involving injuries or fatalities could cause irreparable damage to a company’s balance sheet if the incident is reported and goes viral. As the excellent Airmic research document “Roads to Ruin” makes clear, a decisive shortcoming highlighted in the report was “inadequate leadership on ethos and culture”. The report and its follow-up sister document, “Roads to Resilience” also identified blindness to risk to reputation as weaknesses.

In short: preventing accidents at work is not just the right thing to do in terms of saving lives but from a hard headed business point of view it might also just save your business. And that’s no joke.

Tags:

Hidden Image: