Life insurance policies are critical financial planning tools designed to provide financial security for policyholders’ beneficiaries upon their demise. They work by offering a lump-sum payment, known as a death benefit, to beneficiaries after the insured person’s death.

However, some life insurance policies offer an additional feature – the accumulation of cash value over time.

This is a unique feature that allows the policyholder to access a portion of the insurance money during their lifetime. This article will delve further into the types of life insurance policies that generate immediate cash value.

Table of Contents

- Decoding Cash Value in Life Insurance

- Understanding Different Life Insurance Policies

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Life Insurance Policies That Generate Immediate Cash Value

- Whole Life Insurance and Cash Value

- Universal Life Insurance and Cash Value

- A Word of Caution on Universal Life Insurance

- Factors Influencing Cash Value Growth

- Premium Payments

- Policy Expenses

- Interest Rates

- Benefits of Life Insurance With Immediate Cash Value

- Considerations When Choosing a Policy

- The Bottom Line – Immediate Cash Value

Decoding Cash Value in Life Insurance

The cash value in a life insurance policy is a savings component that grows over time. This feature is inherent in permanent life insurance policies, unlike term life insurance policies that only provide coverage for a predetermined period.

When a policyholder pays premiums towards a permanent life insurance policy, a portion of these payments contributes towards building the cash value.

This cash value grows over time and can be accessed by the policyholder during their lifetime, offering an extra layer of financial security.

Understanding Different Life Insurance Policies

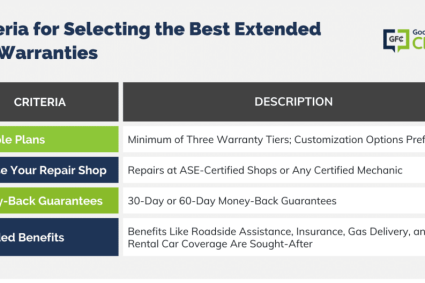

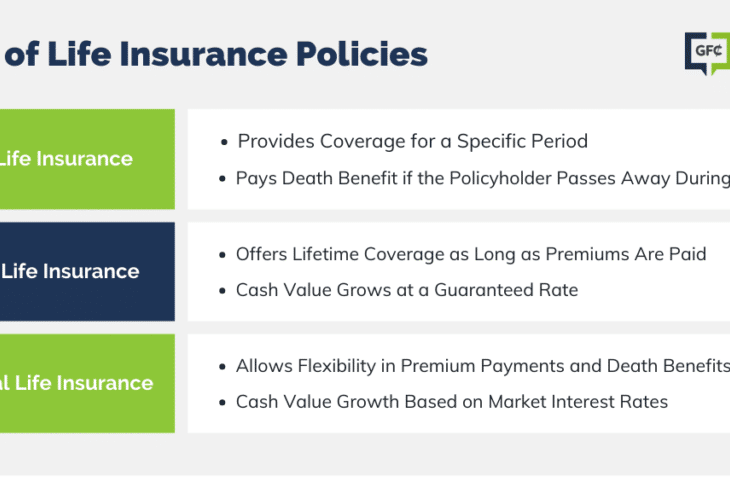

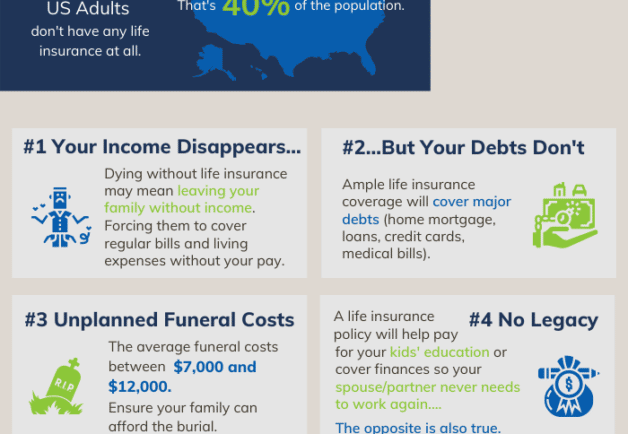

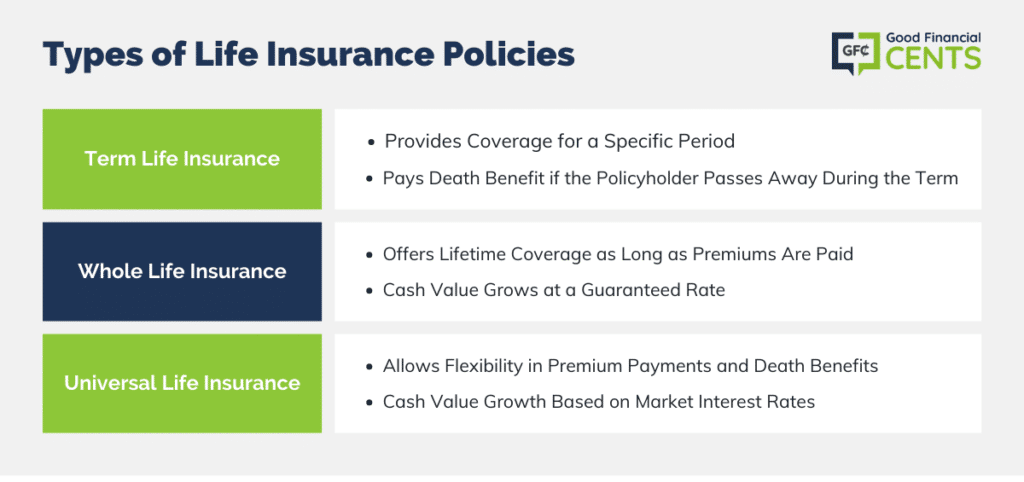

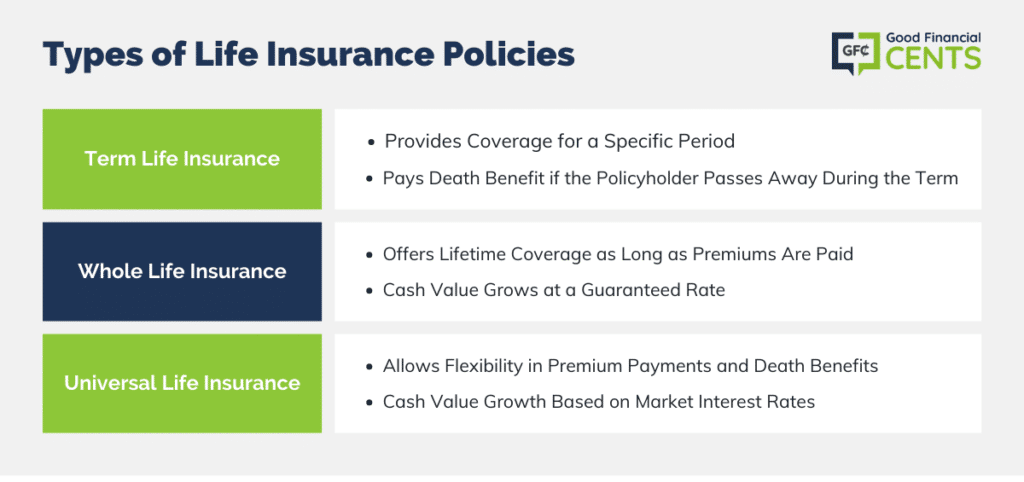

The life insurance market is diverse, offering several types of policies. Some of the main types include term life insurance, whole life insurance, and universal life insurance. Each of these has its unique features, advantages, and suitability for different individuals.

Term Life Insurance

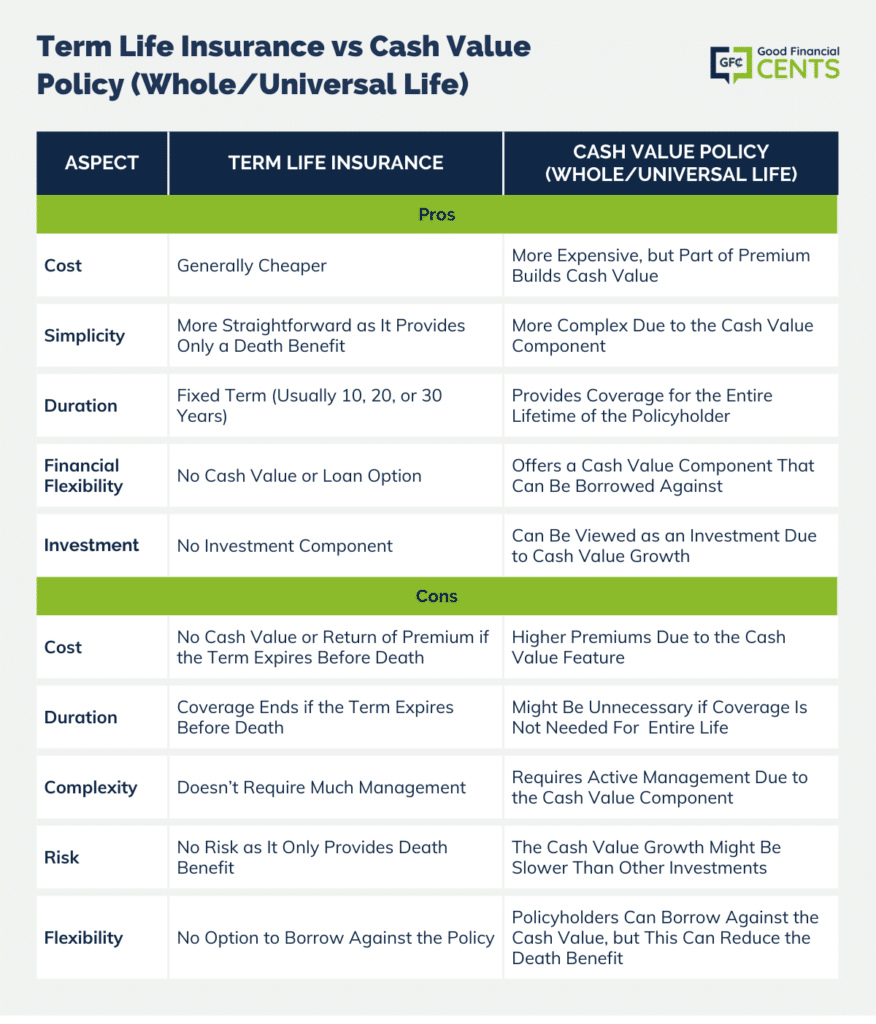

As highlighted by CNBC, term life insurance is designed to offer coverage for a specific period, typically 10, 20, or 30 years. If the policyholder passes away during this term, the insurance company pays a death benefit to the beneficiaries.

However, according to financial experts like Dave Ramsey, it could be the best option for most people because it’s simple and affordable. It’s like an umbrella for a rainy day, shielding your loved ones financially if you pass away during the policy term.

However, term life insurance does not provide any cash value component. It’s often chosen for its affordability and simplicity, focusing solely on providing financial protection in the event of the policyholder’s death during the policy term.

Whole Life Insurance

Whole life insurance, as the name suggests, offers coverage for the insured person’s entire lifetime as long as the premiums are paid. Unlike term life insurance, it combines a death benefit with a cash value component.

A portion of the premiums paid contributes to this cash value, which grows over time. Importantly, this growth is at a guaranteed rate, offering predictability and security for the policyholder. According to The Motley Fool, this type of insurance is often more expensive than term life insurance due to its cash value component and the lifetime coverage it provides.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance policy that combines a death benefit with a cash value component. However, it differentiates itself with its flexibility in premium payments and death benefits. The cash value component in universal life insurance grows based on prevailing market interest rates.

Policyholders can adjust the premium amount and death benefit within certain limits, providing them with a degree of control over the policy’s costs and benefits.

Life Insurance Policies That Generate Immediate Cash Value

Among the various life insurance policy options, it’s the whole life insurance and universal life insurance policies that generate immediate cash value. From the moment these policies are enforced, the cash value starts growing, offering policyholders access to a part of their insurance payout during their lifetime.

Whole Life Insurance and Cash Value

With whole life insurance policies, the cash value grows at a guaranteed rate, offering a predictable savings growth mechanism. The cash value of whole life insurance is built from the premiums paid by the policyholder. This cash value can be borrowed against, offering a valuable source of funds when needed. Alternatively, the policyholder can choose to surrender the policy and receive the accumulated cash value.

Universal Life Insurance and Cash Value

Universal life insurance is a form of permanent life insurance policy that combines the death benefit of term insurance with a cash value component. This type of policy is known for its flexibility, as it allows policyholders to adjust the premium payments and death benefits within certain limits. This flexibility can be instrumental in managing life’s financial uncertainties.

The cash value of universal life insurance grows based on prevailing market interest rates, offering the potential for significant growth during periods of high-interest rates. It’s important to note that while this offers an opportunity for financial gain, it can also present challenges. In periods of low interest rates, the cash value growth can slow down, potentially affecting the policy’s overall value.

Policyholders can access the cash value in a universal life insurance policy through withdrawals or policy loans. This can offer valuable financial flexibility in times of need.

A Word of Caution on Universal Life Insurance

While universal life insurance offers flexibility and potential cash value growth, it’s not without risks. According to the New York Department of Financial Services, policyholders must be cautious about the fluctuating costs and benefits of these policies.

Interest rates can fluctuate, and when they’re low, the cash value of a universal life insurance policy may not grow as expected. This could mean that the policyholder has to pay higher premiums to keep the policy active, especially if the policy costs are being paid from accumulated cash value.

Policyholders should regularly review their universal life insurance policies. If the policy’s cash value is depleting faster than expected, or if the policy costs are increasing, it might be necessary to adjust the premiums or the death benefit to keep the policy in force.

Beware of UL Insurance

Universal life insurance policies also often have complex cost structures, with various fees and charges that can affect the cash value and the death benefit. It’s important to understand these costs and to consider them when deciding on a universal life insurance policy.

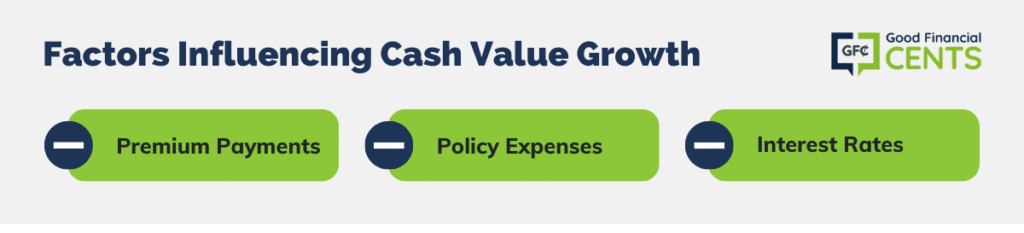

Factors Influencing Cash Value Growth

The growth of cash value in a life insurance policy is subject to several factors. These can vary greatly from policy to policy, and understanding them can help policyholders make an informed decision. The following are some critical factors:

Premium Payments

The amount of premium paid and the frequency of the payments directly impact the growth of the cash value. Regular and timely premium payments can accelerate the accumulation of cash value over time.

Policy Expenses

Insurance policies come with various expenses, such as administrative fees, mortality charges, etc. These charges are typically deducted from the premium payments before the remaining amount is allocated to the cash value component, thus potentially affecting its growth rate.

Interest Rates

The interest rate at which the cash value grows plays a significant role in its accumulation. A higher interest rate leads to a quicker accumulation of cash value, while a lower rate may slow it down. This is particularly relevant for universal life insurance policies where the interest rate is tied to the prevailing market rates.

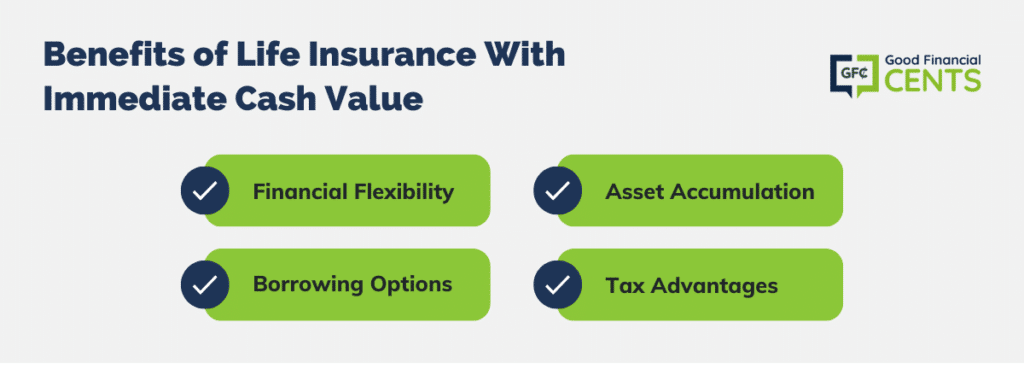

Benefits of Life Insurance With Immediate Cash Value

Opting for a life insurance policy with immediate cash value can offer several benefits:

- Financial Flexibility: The cash value in these policies can be accessed during the policyholder’s lifetime, providing financial flexibility for various needs such as emergencies, education expenses, or retirement planning.

- Asset Accumulation: The cash value component of the policy acts as an asset that can grow over time. It can serve as a source of additional funds or supplement retirement income.

- Borrowing Options: Policyholders can borrow against the cash value of their life insurance policy. This can be a convenient source of funds without the need for a separate loan application or credit check.

- Tax Advantages: The growth of cash value in a life insurance policy is typically tax-deferred. This means that policyholders can enjoy the growth without immediate tax obligations until they withdraw or surrender the policy.

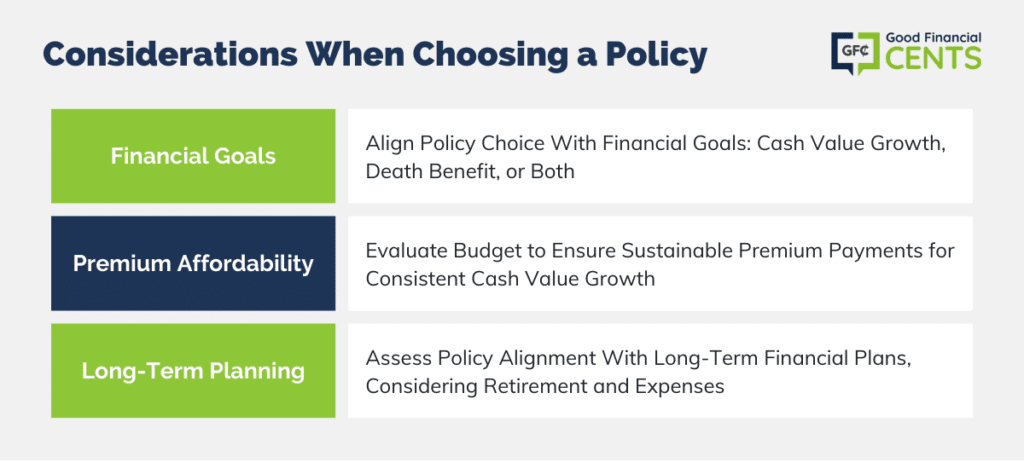

Considerations When Choosing a Policy

When selecting a life insurance policy with immediate cash value, it’s important to consider the following factors:

- Financial Goals: Determine your financial goals and how the policy aligns with them. Consider whether you prioritize cash value growth, death benefit coverage, or a combination of both.

- Premium Affordability: Evaluate your budget and ensure that the premium payments are affordable in the long run. Remember that missing premium payments can impact the cash value growth and policy coverage.

- Long-Term Planning: Assess your long-term financial plans and how the policy fits into them. Consider factors such as retirement, education expenses, and other financial milestones.

As Life Happens points out, life insurance is valuable at any age. It’s not just for when you’re in your golden years and start worrying about leaving a financial safety net for your loved ones. With policies that offer immediate cash value, you’re getting both protection and a financial resource you can access during your lifetime.

Remember that gem of a piece of advice from Dave Ramsey? He says, “Term life insurance is bought, while whole life insurance is sold.”

This simply means that term life insurance, with its lower cost and straightforward benefits, is generally the go-to choice for most people. However, the whole life insurance policies, with their additional features, are actively promoted by insurance companies.

Keep in mind that in the wild world of insurance, there’s no right or wrong choice, only what works best for you. It’s like trying to choose between a coffee and a milkshake – they both have their perks, but it ultimately depends on your taste (or, in this case, your financial goals).

Are you someone who wants protection with the added benefit of cash value growth, or do you prefer a no-frills approach with just coverage? Can you consistently afford the premium payments to reap the full benefits? How does a policy fit into your long-term plan, considering things like retirement, education expenses, or other financial milestones?

The Bottom Line – Immediate Cash Value

Choosing a life insurance policy with immediate cash value can provide both protection and financial flexibility. Whole life insurance and universal life insurance policies are two types that offer this benefit. Understanding the factors that influence cash value growth and considering personal financial goals are crucial when making a decision. By selecting the right policy, individuals can secure their loved ones’ future while also building a valuable asset.

The post Types of Life Insurance That Generate Immediate Cash Value appeared first on Good Financial Cents®.